Fascination About Home Renovation Loan

Fascination About Home Renovation Loan

Blog Article

Home Renovation Loan Fundamentals Explained

Table of ContentsSome Ideas on Home Renovation Loan You Should KnowEverything about Home Renovation LoanThe 9-Second Trick For Home Renovation LoanThe Greatest Guide To Home Renovation LoanThe 4-Minute Rule for Home Renovation LoanThe 4-Minute Rule for Home Renovation Loan

If you are able to access a lower home loan price than the one you have presently, refinancing may be the most effective option. By making use of a home loan re-finance, you can potentially free the funds needed for those home renovations. Super Brokers mortgage brokers do not bill fees when in order to give you funding.Also better, payment alternatives are up to you. These settlements can be made month-to-month, semi-monthly, bi-weekly, bi-weekly increased, and weekly.

Excitement About Home Renovation Loan

Credit scores card rate of interest can intensify quickly and that makes it considerably more difficult to repay if you aren't specific that you can pay it off in no time (home renovation loan). Despite having limited-time low passion price offers, charge card rates of interest can climb up. Generally, credit rating card rate of interest can hit around 18 to 21 percent

Unlike typical home financings or individual fundings, this form of financing is tailored to resolve the expenditures connected with home renovation and restoration tasks. It's a great alternative if you want to enhance your home. These lendings come in helpful when you desire to: Enhance the looks of your home.

Increase the general value of your home by updating areas like the kitchen, bathroom, or perhaps adding new spaces. A Restoration lending can have several benefits for debtors. These can consist of: This indicates that the financing quantity you receive is established by the predicted rise in your residential property's worth after the improvements have been made.

The 45-Second Trick For Home Renovation Loan

That's because they normally include reduced rates of interest, longer settlement periods, and the capacity for tax-deductible passion, making them an extra cost-effective remedy for funding your home improvement restorations - home renovation loan. A Renovation funding is excellent for house owners who intend to change their space as a result of the adaptability and benefits

There are a number of reasons that a house owner could intend to secure a restoration financing for their home enhancement project. -Carrying out renovations can significantly enhance the worth of your property, making it a wise investment for the future. By boosting the aesthetic appeals, functionality, and overall allure of your home, you can anticipate a greater return on investment when you choose to market.

This can make them an extra cost-efficient method to fund your home enhancement jobs, minimizing the total financial worry. - Some Home Restoration finances use tax reductions for the rate of interest paid on the car sites loan. This can assist lower your gross income, supplying you with added savings and making the financing extra inexpensive over time.

Our Home Renovation Loan Statements

- If you have numerous home renovation projects in mind, a Restoration funding can assist you consolidate the prices into one workable financing settlement. This enables you to simplify your financial resources, making it simpler to monitor your expenditures and budget plan efficiently. - Remodelling finances often feature adaptable terms and settlement options like a 15 year, two decades, or thirty years financing term.

- A well-executed renovation or upgrade can make your home much more appealing to potential customers, enhancing its resale potential. By purchasing premium upgrades and improvements, you can bring in a wider variety of possible purchasers and boost the possibility of safeguarding a desirable sale cost. When thinking about a remodelling finance, it's vital to comprehend the various alternatives offered to find the one that finest fits your demands.

Equity is the distinction in between your home's existing market price and the amount you still owe on your mortgage. Home equity finances usually have taken care of rate of interest and settlement additional info terms, making them a predictable choice for property owners. is similar to a credit card because it gives a rotating credit line based upon your home's equity.

After the draw duration ends, the settlement stage begins, and you have to repay the obtained amount with time. HELOCs normally come with variable rates of interest, which can make them much less predictable than home equity finances. is a government-backed home mortgage guaranteed by the Federal Housing Administration that incorporates the expense of the home and remodelling costs right into a single lending.

Unknown Facts About Home Renovation Loan

With a low deposit demand (as low as 3.5%), FHA 203(k) loans can be an attractive choice for those with restricted funds. one more choice that permits consumers to fund both the acquisition and improvement of a home with a solitary home loan. This car loan is backed by Fannie Mae, a government-sponsored enterprise that provides home mortgage financing to loan providers.

Furthermore, Title I finances are available to both homeowners and property managers, making them a versatile option for numerous scenarios. A Financing Officer at NAF can answer any questions you have and assist you recognize the various kinds of Home Remodelling finances readily available. They'll also aid you locate the best option suited for your home renovation needs and financial scenario.

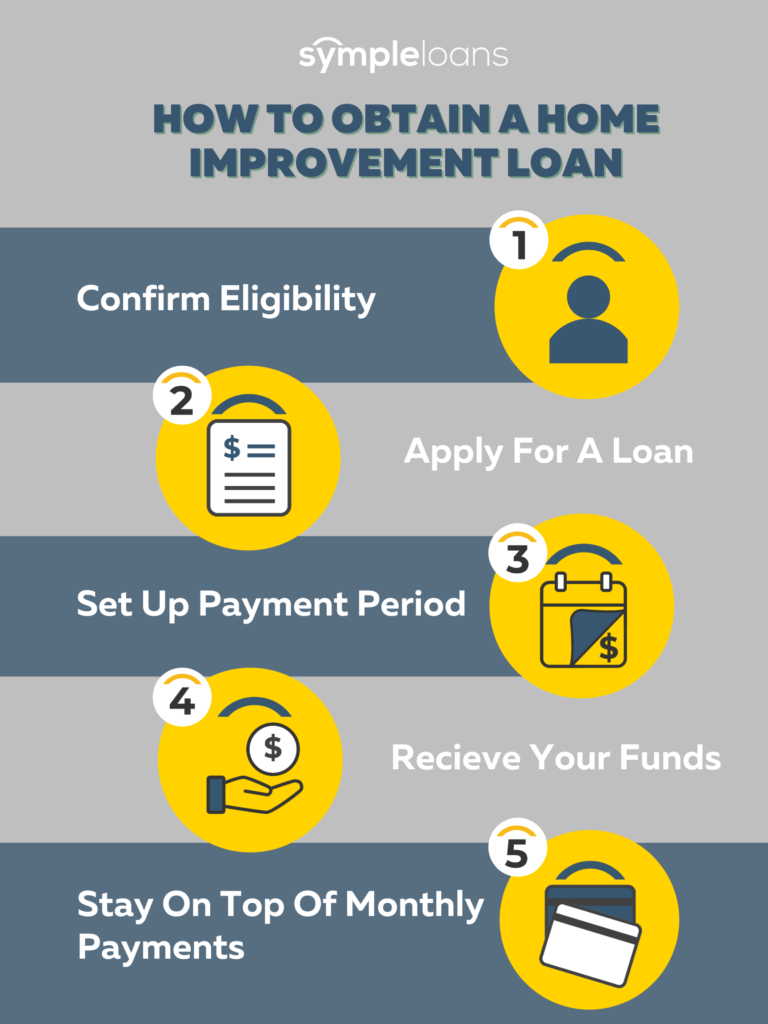

As an example, if you're seeking to make energy-efficient upgrades, an EEM could be the very best option for you. On the various other hand, if you're a veteran and intend to purchase and restore a fixer-upper, a VA Improvement Funding might be a perfect choice. There are numerous actions involved in securing a home restoration funding and NAF will help direct you via all of them.

Top Guidelines Of Home Renovation Loan

- Your credit history score plays a significant role in protecting a remodelling lending. It impacts your loan eligibility, and the rate of interest prices lenders supply.

A higher credit history may result read the full info here in much better car loan terms and lower interest rates. - Put together important documents that lenders need for financing approval. These might consist of proof of revenue, income tax return, credit rating, and thorough details concerning your improvement job, such as contractor quotes and blueprints. Having these documents ready will certainly accelerate the application procedure.

Report this page